In eCommerce, every small detail at the checkout stage matters. Shoppers may love your products, engage with your content, and even add items to their cart—but if they hit a barrier when paying, the sale is gone. That’s why payment options are not just a technical detail, but a powerful driver of trust and conversions.

Offering multiple payment options ensures customers feel safe, respected, and free to complete their purchase in the way they prefer. In this article, we’ll explore why payment methods matter, the psychology behind choice, how they boost trust and conversions, best practices, and potential challenges.

Payment options are the methods that allow customers to complete transactions in online stores. Traditionally, this was limited to credit or debit cards. Today, the landscape is much broader and includes:

The best stores don’t offer every method possible but instead prioritize the most relevant and trusted ones for their audience. To help international shoppers feel more confident at checkout, a currency conversion API can display prices in the customer’s local currency.

Payment is the final step of the customer journey, and one of the most fragile. Research shows that nearly 70% of online carts are abandoned, and a significant reason is the absence of preferred payment methods.

Here’s why they matter:

In short, payment variety is directly linked to higher sales, lower abandonment, and broader market access.

Shopping isn’t just rational, it’s emotional and psychological. Payment choice signals trust and empowerment. When customers see multiple payment options, they interpret it as:

This perception reduces hesitation. Instead of worrying about safety or inconvenience, customers feel confident and in control, making them more likely to click “Complete Order.”

When customers reach the checkout page, they are moments away from converting. Yet, this is also the stage where hesitation is highest. Shoppers may worry about payment security, convenience, or whether their preferred method is available. By offering multiple payment options, you remove these barriers and transform checkout into an opportunity to strengthen trust and encourage conversions.

Here’s how it benefits your business:

Recognizable brands like PayPal, Visa, Mastercard, or Apple Pay act as instant trust signals. Even if customers have never bought from your store before, the presence of these payment providers reassures them that your checkout process is legitimate and secure. This psychological effect is especially powerful for first-time buyers who might otherwise hesitate. A store that only offers direct credit card entry may look risky, while a store with multiple trusted options instantly feels safer.

Cart abandonment remains a persistent challenge in eCommerce, and one of the top reasons shoppers walk away is the lack of a preferred payment method. For example, a shopper who prefers PayPal may abandon a purchase if only credit cards are accepted. By accommodating various preferences, such as credit cards, digital wallets, BNPL, you remove excuses to leave. This reduces friction and ensures more of your potential buyers actually complete their purchases.

If you’re targeting global customers, offering localized payment solutions is crucial. In China, shoppers trust Alipay and WeChat Pay; in the Netherlands, iDEAL is the go-to; and in Latin America, many rely on bank transfers or COD. Without these, international visitors may be unable or unwilling to pay. By including local methods, you not only win trust but also unlock entire customer segments you might otherwise miss.

Flexible options like Buy Now, Pay Later (BNPL) give customers the freedom to spread out payments. This reduces the perceived financial burden and encourages them to buy more expensive items or increase their order size. Instead of hesitating over a $300 product, a shopper may confidently proceed knowing they can split the payment into smaller installments. This directly raises your average order value (AOV).

Trust and convenience don’t just lead to one-time conversions—they foster long-term relationships. Once customers know your store offers secure, flexible, and convenient payment choices, they are more likely to return. A smooth payment experience builds loyalty, as buyers feel confident that they can always complete transactions without issues.

In short, multiple payment options reduce friction, build instant trust, cater to different demographics and regions, and encourage both larger and repeat purchases. They turn the checkout process from a potential dropout point into a competitive advantage that steadily boosts conversion rates.

Adding multiple payment methods is powerful, but execution matters. Simply crowding your checkout with every option available can overwhelm customers and increase complexity for your business. The key is to design a system that is customer-friendly, secure, and efficient to manage. Here are the best practices to follow:

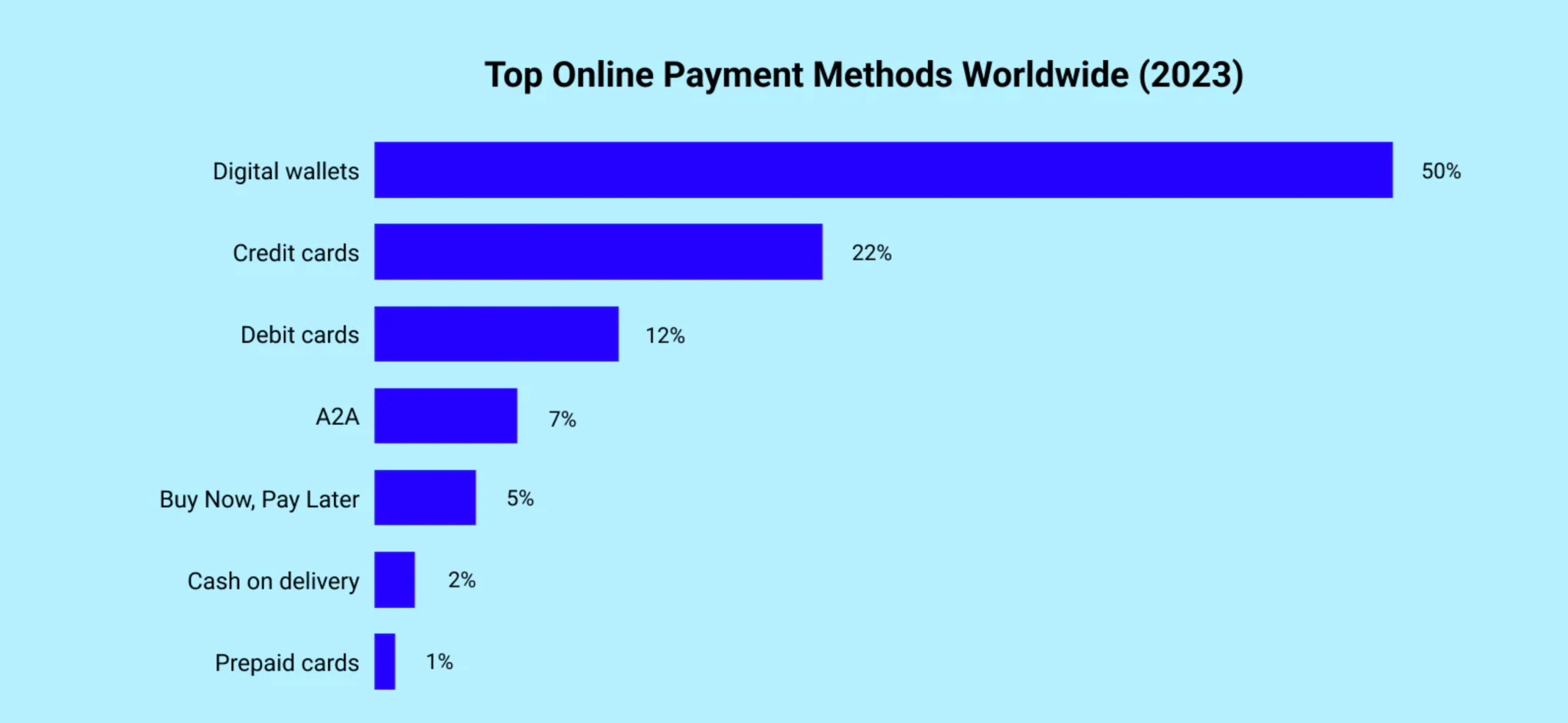

(Source: Worldpay)

Not all payment methods are equally important. Credit and debit cards, PayPal, and Apple Pay are universally recognized and trusted by millions of shoppers. Place these popular options at the top of your checkout to minimize friction. Less common methods can still be offered, but they should be secondary. By making the most widely used options visible and easy to access, you streamline the checkout process for the majority of your customers.

With more than half of eCommerce transactions happening on smartphones, mobile optimization is essential. Payment buttons should be large enough for easy tapping, forms should support autofill, and options like Google Pay or Apple Pay should be integrated for one-tap checkouts. A clunky mobile checkout often leads to abandonment, so mobile-first design is critical when offering multiple payment methods.

Offering too many choices without organization can confuse or frustrate shoppers. Group similar payment methods together, such as digital wallets in one section and installment plans in another. Use clean design to prevent visual clutter. Remember, clarity builds confidence, while confusion drives abandonment.

Security is a major concern for online shoppers. Display SSL certificates, trust badges, and secure gateway logos to reassure customers. Be transparent about fees, if applicable—especially for services like BNPL where additional charges might apply. The more confidence you inspire, the smoother the conversion process will be.

If your store sells internationally, research which payment methods dominate in each region. For instance, Klarna is big in Scandinavia, while Alipay and WeChat Pay dominate in China. By tailoring your checkout experience to different regions, you show respect for local preferences and eliminate barriers to purchase.

Customer behavior evolves. New options like BNPL or cryptocurrency are growing, while some older methods may decline. Use analytics to track which payment methods are most used, test new ones with limited rollouts, and refine your mix over time. This ensures your checkout remains relevant and effective.

Payment failures frustrate customers more than limited options. Work with reliable payment gateways like Stripe, PayPal, or Shopify Payments to ensure uptime, fast processing, and smooth integration with your store. Regularly test your checkout process to catch issues before they affect buyers.

By following these best practices, you create a checkout that is fast, intuitive, and trustworthy. The right mix of payment options isn’t about quantity, but it’s about offering the methods your customers value most, presenting them clearly, and ensuring they work seamlessly every time.

While offering multiple payment options provides clear benefits, it also introduces certain challenges that businesses must carefully manage. Ignoring these can lead to inefficiencies, reduced profits, or even customer frustration. Understanding these challenges allows you to plan ahead and make strategic decisions.

Each payment method comes with different transaction fees. For example, credit card processors may charge between 2–3%, while BNPL providers or digital wallets often add higher rates. If customers heavily favor these costlier options, your profit margins can shrink. To manage this, businesses should balance customer demand with financial viability, absorbing some fees for customer convenience while encouraging lower-cost methods when possible.

The more payment providers you use, the more complicated accounting and reconciliation become. Each gateway has its own dashboard, reporting system, and settlement schedule. This increases the workload for finance teams and may require specialized tools or software integrations to streamline processes. For small businesses with limited staff, managing multiple systems can be overwhelming without proper automation.

Some payment methods carry higher risks of fraud or chargebacks. For example, credit card payments may be subject to stolen card use, while BNPL transactions sometimes increase default risks. To counter this, businesses need to invest in advanced fraud detection tools, implement secure authentication protocols, and work with reputable payment gateways that provide built-in fraud protection.

Offering too many choices can backfire. When shoppers face an endless list of payment options, they may feel overwhelmed or uncertain about which to choose. This “decision fatigue” can delay purchases or even cause abandonment. The key is striking a balance, offer enough variety to satisfy preferences, but keep the checkout page simple and intuitive.

Not all payment gateways integrate smoothly with every eCommerce platform. Technical challenges such as compatibility issues, setup delays, or maintenance requirements can frustrate both businesses and customers. Choosing reliable partners like Stripe, PayPal, or Shopify Payments minimizes these headaches, but ongoing monitoring is still necessary to ensure seamless functionality.

By being aware of these challenges, businesses can prepare solutions that maximize the benefits while minimizing the risks. A thoughtful approach, prioritizing customer needs, maintaining clear checkout design, and partnering with trustworthy providers, ensures that multiple payment options remain a competitive advantage rather than a burden.

In the world of eCommerce, trust and convenience are everything. Offering multiple payment options directly addresses both. Shoppers feel secure when they see familiar providers, empowered when they have choice, and satisfied when the process is smooth and flexible.

The result? Lower cart abandonment, higher conversion rates, increased average order values, and stronger customer loyalty.

Yes, multiple payment methods require investment, management, and careful integration. But in return, they deliver one of the most reliable boosts to your bottom line. In today’s global and digital-first marketplace, providing diverse payment options isn’t just good practice—it’s essential for sustainable growth.

Post-purchase rewards become a strategic growth lever rather than just a marketing add-on. By rewarding customers after checkout, brands can extend engagement, shape future behavior, and create a clear path toward a second purchase.

In a competitive market where attention spans are short, complexity becomes a silent engagement killer. This article explores why over-complicated loyalty rules reduce participation and, more importantly, how brands can simplify their programs without sacrificing effectiveness.

In this article, we’ll explore in detail how user-generated photos improve product pages and why they’ve become an essential part of high-converting eCommerce strategies.